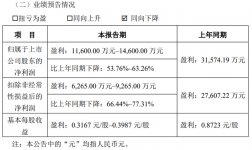

On January 8th, Shenzhen Absen Optoelectronic Co., Ltd. released its 2024 performance forecast, projecting a net profit attributable to the parent company of 1.16 billion to 1.46 billion yuan, marking a year-on-year decline of 53.76% to 63.26%. The non-GAAP net profit is expected to be 626.5 million to 926.5 million yuan, reflecting a year-on-year decrease of 66.44% to 77.31%. Basic earnings per share are anticipated to be 0.3167 to 0.3987 yuan per share.

During the reporting period, the company achieved an operating revenue of approximately 36.73 billion yuan, an 8.33% decline compared to 2023. Notably, through years of meticulous cultivation and strategic positioning in overseas markets, the company has built a differentiated brand advantage, significantly enhancing its competitiveness abroad. Overseas markets demonstrated robust growth, contributing 28.83 billion yuan in revenue, an 11.93% increase year-on-year. In contrast, the domestic market, influenced by economic conditions and competitive pressures, saw a shift in strategy from scale expansion to focusing on high-value customers, resulting in revenue of 7.90 billion yuan, a 44.80% drop compared to the same period in 2023.

The company's gross margin for the reporting period stood at 28.34%, a slight 1.23% decrease from 2023. Faced with competitive challenges, the company proactively implemented strategies such as cost control, pricing optimization, and product portfolio adjustments. These efforts led to an improvement in gross margin in the second half of the year compared to the first half.

Guided by strategic foresight and a commitment to long-term investment, the company closely aligned its product strategy with market demands, enhancing its R&D capabilities. Its outstanding product performance and deep technical expertise earned it the prestigious title of "National Manufacturing Single Champion".

Simultaneously, the company strengthened key areas such as talent development, brand marketing, channel building, and operational efficiency to boost overall competitiveness. However, the advancement of these strategic initiatives led to increased expenses compared to 2023, impacting net profit.

Non-recurring gains and losses are expected to contribute approximately 533.5 million yuan to net profit (compared to 396.696 million yuan in 2023), primarily due to government subsidies, the reversal of impairment provisions for receivables, and returns from investments of idle funds.

From a user experience perspective, the company's focus on overseas markets and high-value customers demonstrates a customer-centric approach, ensuring tailored solutions for diverse markets. Its emphasis on R&D and operational excellence reflects a commitment to delivering high-quality, innovative products that meet evolving customer needs. While financial performance faced challenges, the company's strategic investments position it for sustainable growth and enhanced user satisfaction in the long term.

During the reporting period, the company achieved an operating revenue of approximately 36.73 billion yuan, an 8.33% decline compared to 2023. Notably, through years of meticulous cultivation and strategic positioning in overseas markets, the company has built a differentiated brand advantage, significantly enhancing its competitiveness abroad. Overseas markets demonstrated robust growth, contributing 28.83 billion yuan in revenue, an 11.93% increase year-on-year. In contrast, the domestic market, influenced by economic conditions and competitive pressures, saw a shift in strategy from scale expansion to focusing on high-value customers, resulting in revenue of 7.90 billion yuan, a 44.80% drop compared to the same period in 2023.

The company's gross margin for the reporting period stood at 28.34%, a slight 1.23% decrease from 2023. Faced with competitive challenges, the company proactively implemented strategies such as cost control, pricing optimization, and product portfolio adjustments. These efforts led to an improvement in gross margin in the second half of the year compared to the first half.

Guided by strategic foresight and a commitment to long-term investment, the company closely aligned its product strategy with market demands, enhancing its R&D capabilities. Its outstanding product performance and deep technical expertise earned it the prestigious title of "National Manufacturing Single Champion".

Simultaneously, the company strengthened key areas such as talent development, brand marketing, channel building, and operational efficiency to boost overall competitiveness. However, the advancement of these strategic initiatives led to increased expenses compared to 2023, impacting net profit.

Non-recurring gains and losses are expected to contribute approximately 533.5 million yuan to net profit (compared to 396.696 million yuan in 2023), primarily due to government subsidies, the reversal of impairment provisions for receivables, and returns from investments of idle funds.

From a user experience perspective, the company's focus on overseas markets and high-value customers demonstrates a customer-centric approach, ensuring tailored solutions for diverse markets. Its emphasis on R&D and operational excellence reflects a commitment to delivering high-quality, innovative products that meet evolving customer needs. While financial performance faced challenges, the company's strategic investments position it for sustainable growth and enhanced user satisfaction in the long term.